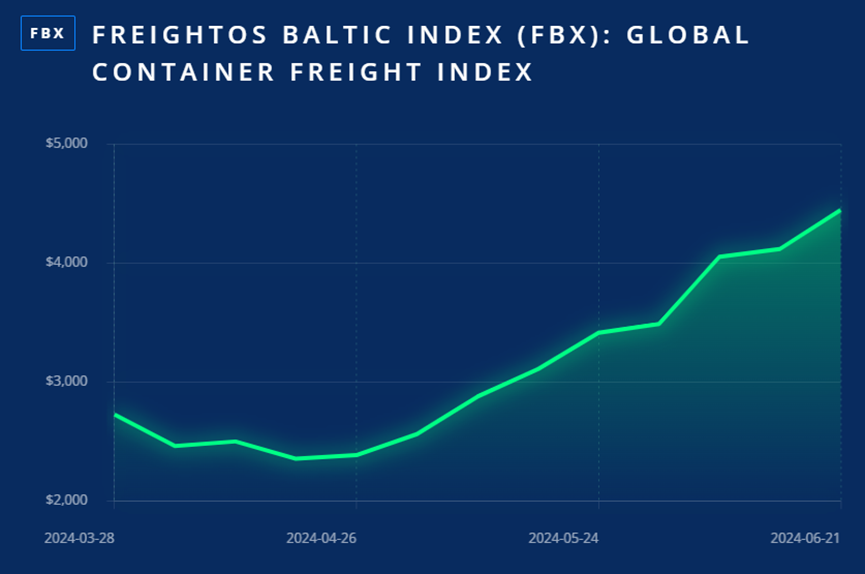

In the field of international trade,The MaritimeThe fluctuation of prices often affects the nerve of the global economy. In June 2024, the flat shipping market saw a surge in shipping costs. According to Freightos’s main shipping platform, the container cash price index FBX shows that international shipping costs rose from about $1,200 per flight in 2023 to $4,500 today, almost 30% higher than the peak of $3,400 in January. This price has already been more than three times the price of last year. Industry insiders believe that the factors driving the unusual rise in shipping costs are complex, and here are a few main reasons.

Global manufacturing recovery and increased capacity

The recovery in the global manufacturing industry is one of the main reasons for the rise in shipping prices, especially in Germany, where the Purchasing Managers Index in May grew at its fastest rate in 22 months. However, the strikes in the major ports of Germany led many exporters to rush to find sufficient capacity. This sharp increase in demand led to a surge in shipping costs.

Meanwhile, shipping capacity is also increasing. According to AxSMarine analyst Jan Tiedemann, the newly delivered container vessels have increased capacity by 2 million containers equal to 20 feet in 2023, making a record. The shipping market is expected to increase capacity by 3 million in this year and another 2 million in 2025 while these additional capacities have somewhat alleviated the tensions, but have not fully offset the impact of the surge in demand.

Protectionism and Tariff Risks

The rise of protectionism is also an important factor driving the rise in shipping costs. The U.S. government has announced a significant increase in tariffs on some Chinese goods, allowing many traders to speed up the delivery of goods to avoid being affected by subsequent tariffs and other policies.

At the same time, the EU is also negotiating with China about electric car tariffs, further aggravating the concerns of international traders.As the worlds three largest economies, China, the United States and the EU trade trends are undoubtedly key influencers of international trade, with the European and American again in the election year this year, the rise of far-right forces in Europe and Trumps return to the White House, and the global supply chain is still a shadow.

Situation and adjustment of the Red Sea route

The tension in the Red Sea itself is also increasing the cost of maritime transportation. Especially for goods across the Eurasian Mediterranean, which now needs to get around a good-looking corner and take two more weeks to complete the sailing, which means traders need to invest more ships to flow balance. According to AxSMarine, a total operational capacity of up to 1 million standard boxes has been put into service this year, but the proportion of the unemployed fleet has fallen to 0.6%. This is the lowest level since February 2022, well below the health level of 3%.

c) Future prospects

Freightos estimates that shipping charges on some routes could rise to $9,000 in the coming months.While the negative effects such as tariff waves and port strikes will gradually diminish later on, the Red Sea crisis remains severe, meaning the high cost of international freight is difficult to see hope of solution in a short time.

Overall, the rise in international shipping charges is the result of a combination of multiple factors. The global manufacturing recovery, the rise of protectionism, the tension in the Red Sea and the adjustment of routes all drive shipping charges to varying degrees. Though the rise in shipping power has somewhat eased the tension, the sharp rise in demand and the complex international situation make it difficult for shipping prices to fall back in the short term. For international traders, finding the best operating strategy in high shipping charges and complex international environments will be an important challenge to face in the future.

Follow customer service WeChat

Follow customer service WeChat