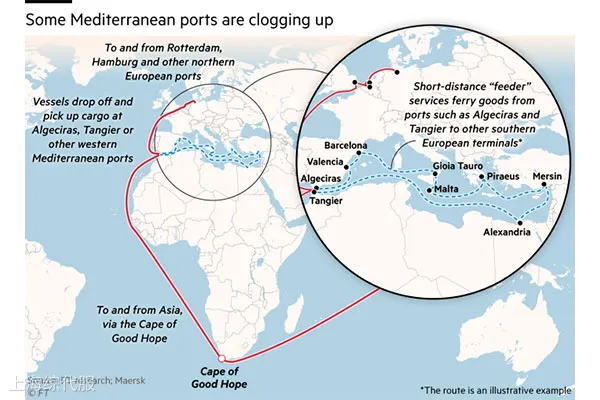

Recently, major container ports in the western Mediterranean have raised concerns about rising inventory costs and shortages for European retailers and manufacturers due to a surge in transportation near full load. Houthi armed threats to the Red Sea Route have led to a large number of cargo ships changing their routes, bypassing the hopeful corners instead of crossing the Suez Canal, increasing the burden on the Mediterranean port of Tangier in Morocco, the port of Algeciras in Spain and the port of Barcelona.

This sudden change of route puts these western Mediterranean ports facing unprecedented challenges. Maersk recently issued a warning to customers that the use of the barracks in the port of Barcelona has gone far beyond normal levels. Alonso Luque, chief executive of TTI Algeciras Terminal at the port of Algeciras, described the severe current situation, saying the terminal was quite full and could only be avoided by limiting the volume of business.

Data from the ship tracking service show that ships in the Port of Algeciras and the Port of Tangier Mediterranean frequently need to land near the port, which is a clear sign of increased port congestion. Terminal operators and local managers are struggling to cope with this increasing pressure, but the port’s logistics capacity is clearly close to its limit.

Nabil Boumezzough, Chairman of the Management Board of Tangier Alliance, revealed that Tangier’s Mediterranean Port has been operating in a state of close to full load since this year. This pressure not only affects the normal operation of ships, but may have far-reaching impacts on the entire supply chain. According to Daniel Richards, director of maritime consultancy MSI, the delay in these ports will force some companies to increase inventories to buffer uncertainty in the supply chain, potentially leading to an increase in overall operating costs.

In actual figures, the port of Barcelona’s container throughput increased by 17% compared to February, but the port of Algeciras and the port of Tangier Mediterranean have not yet released specific transport statistics for this year.

Because these ports are located on both sides of the critical Strait of Gibraltar, their throughput capacity is naturally severely constrained.This situation forces shipping companies to look for alternative ports, such as the more remote port of Malta and the port of Gibraltar, further complicating the transportation and distribution of goods.

In the long run, terminal operators and relevant governments will need to evaluate and adjust existing port facilities and management strategies to address possible similar situations in the future.In addition, rethinking goods distribution and storage strategies and improving port efficiency is also key to solving the problem.

In today’s increasingly tight global trade, such emergencies once again highlight the vulnerability of the supply chain and the importance of global ports as key nodes for freight transportation. European retailers and manufacturers must now pay more attention to the impact of this geopolitical event on the supply chain while seeking more response strategies to reduce potential negative impacts.

Follow customer service WeChat

Follow customer service WeChat