On the eve of the trade boom, traders must not only cope with platform policy changes, but also with uncertainty in logistics delivery, such as overload of warehouses and cabin tensions. More challengingly, the U.S. Customs Border Protection Agency (CBP) frequently increases inspection rates at this time, especially for the value of goods.

Customs inspections in major ports

Inspections vary in major ports, but there are common problems with checkpoints, such as:

Miami port inspections mainly involve value, infringement, EPA and DOT issues, with inspections delayed for about 2 weeks.

? Random inspections in New York ports, mainly for freight value, CPS and FDA issues, with delays of approximately one week.

Testing times in Seattle and Detroit ports may also be delayed by about 2 weeks.

The number of port inspections in Houston has increased, with the inspection time delayed by about one week.

Chicago Port focuses on reviewing the value of goods, CPS and FDA issues.

? Random inspections in the ports of Los Angeles and Oakland showed significant value issues.

? Dallas port inspections are mostly related to cargo value, EPA and CPS issues.

Understanding these circumstances helps the seller adjust the delivery strategy according to the specific circumstances.

How to consult U.S. Customs clearance information

When faced with uncertainty, the following ways can help obtain information:

The U.S. Customs Border Protection Agency (CBP) provides query services, and users can query by entering the tracking number of goods or the name of the sender.

Contact the freight agent or customs agent, they can provide detailed information about the progress of clearance, fees, taxes and so on.

Changes in shipping fees and reserves recommendations

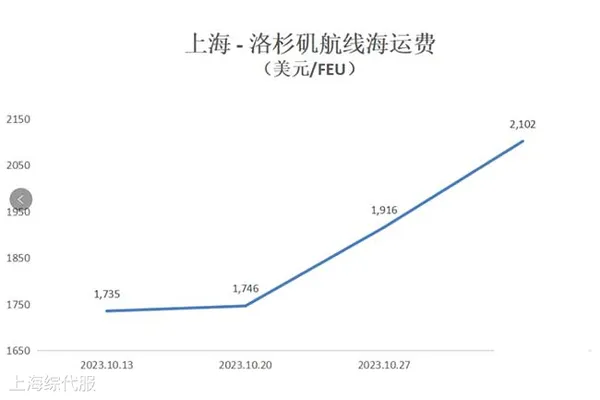

According to data from the Shanghai Shipping Exchange, shipping charges in the Port of Los Angeles have again risen to $2100/FEU. Several shipping companies have been out of cabin in November, showing an improvement in supply and demand. With the Black Friday and Christmas season coming, sellers can consider out-of-season preparation, using third-party overseas storage and distribution of goods to reduce shipping costs.

Follow customer service WeChat

Follow customer service WeChat